Back in April Karatbars International affiliates reported receipt of an email from AcuaWellington.

AcuaWellington represented they’d “taken over all receivables and liabilities of the Karatbars group of companies”.

Further research reveals Acua Wellington is in all likelihood a recovery scam. But not your typical recovery scam.

As supplied by BehindMLM reader Noel, here’s the email AcuaWellington sent out to Karatbars affiliates onl April 28th;

Dear Sir or Madam,

as you may have learned by now, we have taken over all receivables and liabilities of the Karatbars group of companies.

From our records, it appears that you may have receivables from various services.

Due to the special nature of the business and the legal requirements, we kindly ask you to enter your claim via our website.

Please fill in all the fields so that any claims can be settled according to the Know Your Client principle. Your information should be received by May 15, 2022. Late submissions may be rejected. All information is subject to data protection.

We will get back to you after May 15, 2022 without being asked. Your details will be checked in accordance with banking practice. By sending us your data, you expressly agree to this check.

Please understand that communication can only take place in English.

With kind regards

Acua Wellington Risk Management

One of the immediate red flags is Acua Wellington demanding personal information from affiliates.

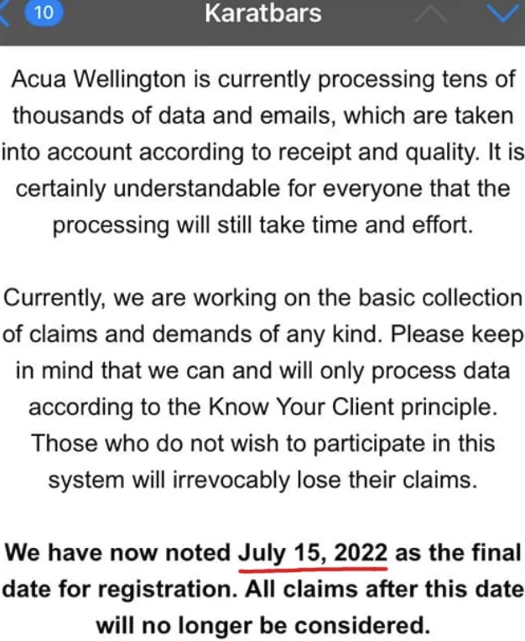

This is an excerpt of a more recent follow up email received by another affiliate;

Currently, we are working on the basic collection of claims and demands of any kind.

Please keep in mind that we can and will only process data according to the Know Your Client principle.

Those who do not wish to participate in this system will irrevocably lose their claims.

Karatbars International’s office FaceBook page was abandoned in late 2020.

Harald Seiz, owner of Karatbars International, has made no public statements regarding Acua Wellington.

So who are Acua Wellington?

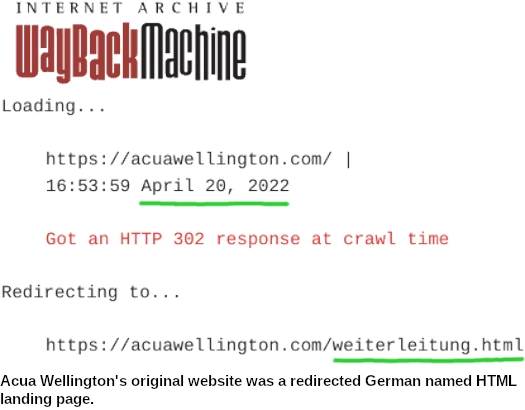

Acua Wellington operates from the domain “acuawellington.com”. This domain was first registered in 2019. The current incomplete registration was updated on January 23rd, 2022.

I believe this is when the current owners took possession of the domain, with the current website going live sometime thereafter.

Despite only existing for a few months, Acua Wellington its “funds are among the most successful in the world.”

Naturally no company ownership information is provided.

What Acua Wellington does provide on its website is a corporate address in New York City. This ties into Acua Wellington’s representations regarding the SEC, which we’ll get into in a bit.

Through the Wayback Machine, we learn Acua Wellington was set up by Germans;

This is significant because Harald Seiz is German and Karatbars International is/was a German company.

Next we have the SEC representations on Acua Wellington’s website:

AcuaWellington is investor-owned. As an investor-owner, you own the funds that own AcuaWellington.

For the 10-year period ended December 31, 2020, the money market funds, bond funds, balanced funds, and stock funds outperformed their peer group averages. Results will vary for other time periods. Only mutual funds and ETFs (exchange-traded funds) with a minimum 10-year history were included in the comparison.

AcuaWellingtons can acquire companies of all types and take them public at any time without going through the traditional IPO process. For this purpose, AcuaWellington can also form a special purpose acquisition company (SPAC), which is subject to the U.S. Securities and Exchange Commission (SEC). Such a SPAC is used to pool funds to finance a merger or acquisition within a specified time frame.

Because a SPAC is registered with the SEC and it is a publicly traded company, the general public can buy its stock before the merger or acquisition occurs.

This is a load of finance bro waffle that has nothing to do with Acua Wellington or Karatbars International.

Our responsibility is reflected in our unique ownership structure, our customer-focused culture and our commitment to ethical principles.

AcuaWellington is owned by its private funds, which in turn are owned by fund shareholders.

Acua Wellington itself is not registered with the SEC. This is a red-flag for a company representing it is US-based and going on about shareholders.

As opposed to having anything to do with “private funds” or shareholders, Acua Wellington is in fact just a shitcoin reload Ponzi scheme.

From the sounds of it AcuaCoin is an ERC-20 shitcoin. These take a few minutes to set up at little to no cost.

AcuaCoin is pegged to ethereum, with Acua Wellington claiming it’s also “hedged via purely corporate assets.”

For obvious reasons, I am skeptical of a company barely a few months old run by persons unknown having significant corporate assets – if any at all.

As of yet there’s no investment opportunity associated with Acua Wellington. That’s probably coming once they figure they’ve got as much ID documents as they’re going to get through KYC.

As above, Acua Wellington has set a July 15th cutoff date for affiliates to provide ID documents to them.

Personally I’m not convinced Karatbars International was sold off. Acua Wellington has German roots and Seiz has been trying to get a new Karatbars shitcoin off the ground since KBC collapsed in 2019.

Acua Wellington is a Karatbars Ponzi reload scheme run by persons unknown. It isn’t based in the US and anyone handing over ID documents is doing so to a third-party of unknown origins.

That Harald Seiz has gone into hiding and not publicly addressed Acua Wellington says it all really. This is not how legitimate businesses operate.