With the future of VPL Medical hanging in the balance, on January 25th CEO Jason Cardiff

told the Court that VPL “is currently talking to HHS and other federal and state agencies and believes that it is very close to landing some major contracts….”

As revealed in a joint operating report filed one month later however;

As of February 24, 2021, no new sales contracts have been executed.

But never fear, the VPL brain-trust has a backup plan.

To be fair it’s not like there’s absolutely nothing going on at VPL.

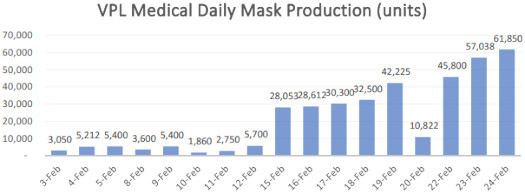

Mask production has ramped up throughout February…

…however the report notes

there is no guarantee that the company will be able to sustain this week’s three-day average output of 54,896 masks.

This potential variability makes performance of any major contract questionable.

Speaking of contracts;

In the absence of any contract for its masks, VPL notes only it will soon be able to sell its masks on Amazon.

I think at this point getting a contract is a long-shot. And Amazon is going to be pushed a fallback.

Out of curiosity I punched in “3 ply masks” into Amazon and 600+ results came up. How VPL is going to compete with masks made cheaply overseas who knows.

From memory the thrust behind securing contracts was requirements that the masks be made in the US to a set standard.

Competing with everyone else on Amazon is hardly comparable.

Should Amazon go nowhere, which it very much could, things are looking bleak.

There is only $1,227,385.70 left in the Receivership Estate.

With no major contracts, this money will be depleted quickly at VPL’s current spending rate.

Ironically the only reason VPL was permitted to go ahead was “potential profitability”.

That was back in September 2020, with the same decision sparing Jason Cardiff from a prison stint.

How much long the courts allow this farce to continue remains to be seen. Surely we’re into sunk-cost fallacy territory by now.

The FTC has requested that, should the court allow VPL to continue draining Receivership funds, that reports be submitted

in 30 days, and every 30 days thereafter, and that future reports specifically include a calculation of the full cost of production for that month’s masks, so that VPL’s competitive position can be meaningfully assessed.

Frequent reports will also enable the Court to monitor the status (or absence) of any sales contracts, which are a critical and as-yet unrealized component of VPL’s potential profitability.

I’ll continue to monitor the case docket for updates.

Update 27th March 2021 – As of March 24th, VPL has still failed to sell a single mask.