There have been rumblings that OmegaPro’s collapse is tied to The Traders Domain, a non-MLM Ponzi scheme that also collapsed in late 2022.

The implication being that OmegaPro investor funds were commingled into The Traders Domain, which was running its own Ponzi.

I haven’t been able to verify anything, and I still can’t – at least not definitively.

But a recently filed regulatory lawsuit has now revealed one concrete link between OmegaPro and The Traders Domain.

The CFTC has filed suit against Yas Castellum LLC, Yas Castellum Financial LLC, Saeg Capital General Management, and several individual defendants.

- Yas Castellum LLC – defunct shell company incorporated in Colorado, registered with the NFA as a commodity pool operator in October 2020, permanently barred from NFA membership in September 2022 for fraud

- Yas Castellum Financial LLC – shell company set up in Hawaii

- Saeg Capital General Management LP (SAEG GM) – shell company incorporated in Delaware, registered with the NFA as a forex and swap firm and commodity pool operator

- Marcus Todd Brisco – Hawaii resident and owner of Yas Castellum and Yas Castellum Financial

- Tin Quoc Tran (aka Tin Quac Tran) – Texas resident and convicted felon, co-owner of Saeg Capital General Management and multiple fraudulent commodity trading pools

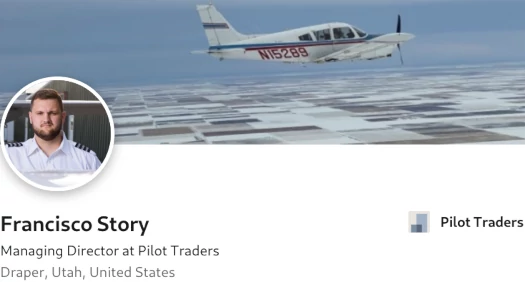

- Francisco Story – Utah resident and co-owner of Saeg Capital General Management

- Frederick Safranko (aka Ted Safranko) – Ontario, Canada resident and co-owner of Saeg Capital General Management and The Traders Domain Ponzi scheme

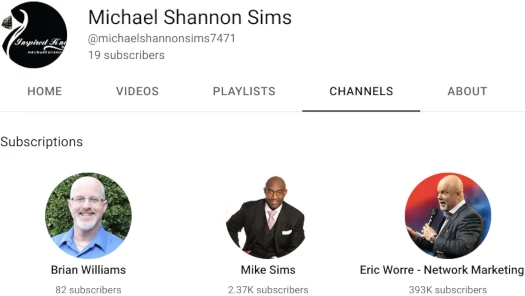

- Michael Shannon Sims – Florida and/or Georgia resident, Marcus Brisco’s brother-in-law, CEO of Yas Castellum and co-owner of OmegaPro

At first I wasn’t 100% sure Michael Shannon Sims was OmegaPro’s Mike Sims.

With a bit of poking around I was able to verify it’s the same guy:

Apparently before getting into financial fraud, Sims ran a menswear business.

In any event, Mike Sims is the link between OmegaPro and The Traders Domain. The CFTC’s lawsuit details a number of fraudulent schemes, through which Sims worked with The Traders Domain owner Ted Safranko.

As alleged by the CFTC;

From at least April 2020 through the present, Marcus Brisco, Yas Castellum LLC, Yas Cestellum Financial LLC, Tin Tran, and Michael Sims, operated three interconnected fraudulent schemes in which they solicited and/or accepted funds, from individuals and entities.

The three fraudulent schemes cited by the CFTC promised returns, purportedly via forex trading and “margined gold-U.S. dollar pair transactions” (XAUUSD).

Advertised returns were based on fabricated historical trading results, averaging 10.95% a month.

OmegaPro launched in early 2019 and pitched a 200% ROI over 16 months, also purportedly derived via forex trading.

Like with OmegaPro, there was of course no trading taking place in the cited fraudulent schemes.

In fact, Yas Castellum LLC, Yas Castellum Financial LLC, Brisco, and Tran did not send any funds to a firm that trades forex or XAUUSD.

Instead, nearly all of the funds were directed to commodity pools controlled and operated by Tran, and Tran Yas Castellum Financial LLC, and Brisco misappropriated a portion of the funds for other purposes.

Things get a bit complicated when it comes to the three cited fraudulent schemes. The CFTC unfortunately does not name the firms.

Nonetheless, here’s how the first one was set up;

In the first of three schemes, which operated from at least October 2020 to May 2022, Yas Castellum LLC and Brisco, the firm’s CEO, fraudulently solicited prospective pool participants to transfer funds to Yas Castellum LLC for the ostensible purpose of participating in a purported Yas Castellum Financial LLC commodity pool.

Among other things, Yas Castellum LLC and Brisco made material representations and omissions regarding where they would maintain Pool Participant funds, how they would trade with those funds, and who would do the trading.

They also provided prospective Pool Participants with false information about Yas Castellum LLC’s historical trading profits.

Brisco did not direct and Pool Participant funds to a firm that trades forex or XAUUSD or maintain funds in a Yas Castellum LLC commodity pool account as promised.

Instead, Brisco transferred most of the Pool Participant funds to the Tran Pools and a small portion to another firm.

Brisco did so at the direction and with the assistance of Mike Sims, his brother-in-law and the purported CEO of the firm that was supposed to trade on behalf of Yas Castellum LLC.

Sims instructed Brisco to disguise the transfers as payments for “services” so the scheme would not be discovered.

To further conceal the scheme, Yas Castellum LLC provided Pool Participants with false weekly account statements created by Brisco that showed their purported trading profits.

The second scheme:

The second fraudulent scheme began in the wake of a March 2022 examination by the National Futures Association (NFA), which identified “serious concerns” about Yas Castellum LLC’s “lack of oversight and control of investor funds”.

In response, Brisco told the NFA that Yas Castellum LLC was ceasing operations.

However, without notifying the NFA, Brisco relaunched Yas Castellum LLC as a new entity, Yas Castellum Financial LLC, and created a new purported commodity pool.

Brisco told prospective Pool Participants that Yas Financial LLC would use the same brokers, platform, and trading strategies as Yas Castellum LLC.

Yas Castellum Financial LLC misappropriated Pool Participant funds by transferring most of the funds to (one of the commodity pools controlled by Tran).

Brisco also misappropriated Pool Participant funds by paying himself for purported trading profits that did not exist.

The third scheme was operated by Tin Tran;

Tran operated a third fraudulent scheme from at least April 2020 to present through which he directly accepted funds intended for trading forex or XAUUSD into one of (his) pools that he controlled.

Tran did not send any Pool Participant funds to a firm that trades forex or XAUUSD.

Instead, he misappropriated some of the Pool Participant funds by using them to pay invoices, unrelated individuals, repay a “loan”, and to subsidize his unrelated businesses.

Tran also commingled pool funds with non-pool property in bank accounts that he controlled.

Funds invested into Tran’s pools through the fraudulent schemes are over $470,780, $1,585,261 and $144,043,883 respectively.

Francisco Story, Ted Safranko and SAEG Capital General Management LP, were part of the conspiracy to hide the fraudulent schemes from regulators.

To conceal Tran’s scheme from regulators, Francisco Story and Ted Safranko, in their roles as directors and officers of SAEG Capital General Management LP, knowingly submitted falsified bank statements to the NFA for (Tran’s first pool) accounts during an examination of SAEG GM.

Safranko and Story described the (Tran’s first pool) accounts as operational accounts that contained seed capital for SAEG GM which the firm used to pay invoices.

Further, they identified Tran as a business associate who helped them with the operational and organizational setup for SAEG GM, and provided seed funding to the firm.

Story and Safranko altered (Tran’s first pool) bank statements to, among other things, omit more than one million dollars of deposits in (Tran’s first pool) accounts that were made for the purpose of trading forex or XAUUSD.

The CFTC alleges that the conduct of the defendants constitute violations of Commodities and Exchange Act.

The CFTC’s case against Brisco and the other defendants was filed on January 31st under seal. After securing a Temporary Restraining Order against the defendants on February 3rd, the case was unsealed on February 14th.

A “show cause” hearing regarding the TRO is scheduled for February 22nd.

Suffice to say Brisco is screwed and I wouldn’t be surprised if criminal charges are pending, I don’t intend to report on the case as I normally would.

Based on what is currently known, parties of interest in the case are Mike Sims and Ted Safranko. Which brings us back to OmegaPro.

Mike Sims is one of OmegaPro’s co-founders. Underneath all the unnamed entities, and likely beyond the scope of the CFTC’s lawsuit, it’s extremely likely Sims commingled Omega Pro funds with his other fraudulent schemes.

These would primarily be cryptocurrency transactions tied to OmegaPro. Pending further regulatory investigations, I can’t provide any specifics.

Supporting this is a number of other MLM Ponzi schemes that fed invested funds into The Traders Domain.

More specific to OmegaPro is it’s collapse timeline. The first sign of money problems within OmegaPro was it’s failed PulseWorld XPL token exit-scam, initiated in early November 2022.

By the end of November BehindMLM called OmegaPro’s collapse, following complete non-payment of withdrawals for three weeks.

After that we had nonsense about hackers and Broker Group, which I’m assuming Mike Sims was behind.

Given all of this, I don’t think The Traders Domain and OmegaPro both collapsing around the same time was a coincidence. It fits the collapse pattern of the other MLM companies feeding into The Traders Domain too well (naturally they’ve also all collapsed).

Sim’s current status is unknown. His Instagram profile was public up until a few weeks ago.

Following BehindMLM confirming Sims was still in Florida as of September 2022 last month, Sims made his Instagram profile private.

Sims’ OmegaPro partners in crime, Dilawar Singh (Germany) and Andreas Szakacs (Sweden)…

…are believed to be laying low in the UAE. The pair fled to Dubai as OmegaPro took off early on.

Beyond Sims, we appear to have two primary culprits responsible for targeting MLM distributors; Holton Buggs and Eric Worre.

I linked to one very early reference of the ties between The Traders Domain and Sims at the start of this article. It’s significant because talk of OmegaPro’s ties to The Trader’s domain primarily surfaced after OmegaPro collapsed.

Here’s the relevant quote;

Eric Worre is rumored to be a 10% owner of Omega Pro. Yes he most likely had a position like he does in several other Network Marketing companies!

The past year everyone is talking about the deal of the century!

The Travis Bot, Lisa Grossman Eric Worre Mile Simms [sic] “Uncle Ted Forex Gold Deal”! This may be one of the biggest Ponzi scheme since Madoff.

Eric Worre tapped into his ($20k per year inner circle group ) advising them to invest $500k or more! Of course now there is no minimum To open a Traders Domain Pamm account with Crypto!

The stories are everywhere. Like Jessie Lee put $1.3M in and now has over $23m ! Eric put in $8m and is making $500k a week! He bought a $20-25M custom G550 jet!

The promise of making 50-70% of the profits monthly! Eric and Mike making 10-20 % on everyone’s money!

-BehindMLM reader Dennis James, July 2022

I can’t verify any of those figures but James tied Worre, Sims and Safranko (aka Uncle Ted) together as far back as July 2022.

Where there’s smoke there’s probably fire.

If all of this fits together as I think it does, given the amount of people involved and the millions laundered (I’d guess over a billion through OmegaPro alone, if not high hundreds of millions), this convoluted web of Ponzi schemes places Sims, Safranko, Worre and Buggs at the center of the largest US-based “in house” MLM Ponzi empire I’ve seen in years.

Beyond the CFTC’s already-filed lawsuit I can’t speak to any other ongoing investigations. If anything further surfaces I’ll leave an update note below.