Earlier today a story on BusinessForHome caught my attention: Vyvo signs $88 million letter of intent with Helo Corp.

Helo Corp? Isn’t that also one of Vyvo owner Fabio Galdi’s companies? Lulwut?

As per BusinessForHome’s coverage;

Vyvo Inc. today announced that it has signed a Letter of Intent effective 31st January, 2020, with a US public listed company, Helo Corp. confirming its $88 million acquisition of certain strategic assets from Vyvo Inc. so that it can bring the VYVO business into a public company.

Alright, so we know Vyvo = Fabio Galdi. What’s the deal with Helo Corp?

Instead of just running one company, Helo Corp was part of Galdi’s Wor(l)d International MLM opportunity.

In a nutshell Helo Corp provided Wor(l)d Global Network with its Helo bands, with Galdi owning both companies. The actual supplier of the Helo devices is Quality Technology Industrial Co., Ltd, a Chinese manufacturing company.

Luckily, as BusinessForHome point out, Helo Corp is publicly listed – meaning we can look up its public SEC filings.

The Company was originally a brokerage, consulting and marketing firm specializing in brand consulting and new product strategy consulting for emerging brands.

The Company focused on natural food products, specialty food products, and mass-market grocery items that were manufactured in North America and sought new market penetration in Eastern Europe.

In October 2014 World Assurance Group, another company effectively owned by Galdi, bought a bunch of Halton Universal Brands shares.

In November 2014 Galdi, through World Assurance Group, renamed Halton Universal Brands to World Media & Technology Corp.

What was left of Halton was acquired by World Assurance Group in December 2014.

Halton’s acquisition netted World Assurance Group $54 in net assets at the time.

This was the Global Mobile Network era, which then became the Wor(l)d International era, which last year became the Vyvo era.

Confused yet? Don’t worry, it gets worse.

World Media & Technology Corp. was renamed World Technology Corp in December 2017.

In October 2018 the company was again renamed to Helo Corp.

Here’s a confusing rundown of how Fabio and Gabriele Galdi essentially own Helo Corp and Vyvo (note that this is from a February 2019 filing, WGN is now Helo).

Mr. Fabio Galdi, our Chairman of the Board and Chief Technology Officer, and his brother Gabriele Galdi, each currently own 50% of WGN.

Until May 2017, Fabio Galdi was the Chief Executive Officer of our company, and currently he serves as the Chief Executive Officer of WGN. Gabriele Galdi is also the owner of 50% of the outstanding equity of WGH, our largest stockholder and an affiliate of WGN.

The remaining 50% of WGH is owned by Alfonso Galdi, the brother of Fabio Galdi and Gabriele Galdi, who owns 28% of WGH, and Alessandro Senatore, a director of our company, who owns 22% of WGH.

Currently, WGH, WGN and their affiliates collectively own approximately 74% of our outstanding common stock.

Got a headache yet? I sure do.

Basically Fabio and Gabriele Galdi own 74% of Helo Corp and, as far as I can tell, own or are the majority owners of Vyvo.

So what on Earth is this nonsense about Fabio Galdi signing an $88 million dollar agreement with himself?

Unfortunately Helo Corp hasn’t filed an annual report since August 2015. Yes, that was four and a half years ago.

The company’s last quarterly financial report was filed in March 2016.

That report reveals Helo Corp (then World Media & Technology Group) lost $1.3 million for the quarter ending September 2015. The company was on track to lose well over $3 million for the financial year ($2.8 million as of September 2015).

Later that same month Helo Corp advised the SEC it was going to miss its annual report deadline.

The stated reason for Helo Corp’s inability to meet SEC filing requirements was

a small accounting staff which has devoted substantial time and effort to recent business matters affecting the Registrant (Helo Corp), and as a result, the attorneys and accountants could not complete the required legal information and financial statements.

In October 2016 Helo Corp informed the SEC it was suspending its duty to file reports.

The two rules cited in support of this notice were Rule 12g-4(a)(1) and Rule 15d-6.

I’ve gone over both Rule 12g-4(a)(1) and Rule 15d-6, and can’t make heads or tails over what either rule has to do with Helo Corp failing to file financial reports.

Anyway, Helo Corp hasn’t filed any financial reports with the SEC since March 2016, almost three years ago.

In February 2018 the company filed a registration statement declaring intent to sell World Technology Corp shares to the public.

Citing “unfavorable market conditions”, the registration statement was withdrawn a year later in April 2019.

Helo Corp has not made any filings with the SEC since then.

Fast forward to today, and Fabio Galdi has announced Vyvo’s intent to buy Helo Corp for $88 million dollars.

To recap:

- Fabio Galdi and his brother Gabriele Galdi effectively own or own the vast majority of Helo Corp and Vyvo

- Helo Corp was losing millions of dollars a year as of its last financial report in 2016

Yet here we have BusinessForHome dutifully reporting Galdi’s intent to acquire his own company for $88 million.

Mr Galdi also confirmed that Helo Corp. will continue to operate under the HLOC ticker until it can change its name to VYVO and update its ticker symbol.

All Galdi has to do is inform the SEC he’s changing Helo Corp’s name to Vyvo. That’s it. The intended $88 million dollar acquisition announcement is pure marketing nonsense.

Seriously Ted, why is this even news? Oh, right.

One last thing I want to finish up with, I noticed on Vyvo’s website they’re now advertising a VYVO token.

VYVO Token is an ERC-20 token on the Ethereum Blockchain.

It is implemented to create a data streaming system based on personal Health and Wellness biodata captured directly from VYVO wearable devices in real-time.

We have large anonymized datasets that are gathered from all VYVO devices.

These datasets present incredibly actionable and interpretable information that could have an impact on how we approach health, wellness, and self-care.

Recently, we have been receiving massive attention among interested parties, with inquiries and desire to purchase the anonymized data, from pharmaceutical companies to a multitude of health institutions.

Selling your customers’ personal health data. Nice.

In exchange for this, naturally Vyvo affiliates and retail customers are rewarded with VYVO tokens.

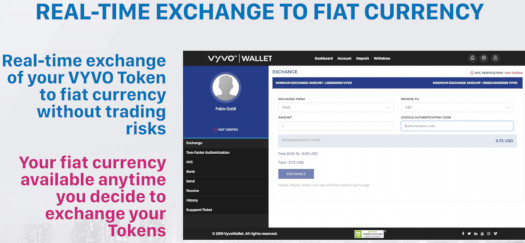

All you have to do is buy one of Vyvo’s Vista devices. Wear it and Vyvo will give you VYVO tokens, which you can then cash out via the company’s internal exchange.

Supposedly withdrawal requests are paid via revenue generated by Vyvo’s efforts to sell data to third-parties. At least that’s what they’re telling their affiliates and retail customers.

Sounds a bit like a passive investment opportunity to me. So how long is all of this going to go unreported to the SEC?