Your Ponzi scheme has collapsed, you found out your partners in crime secretly used your company to launder millions for another Ponzi scheme, and you’re also in the middle of a lawsuit with said partners in crime.

What do you do?

Well… if you’re Oscar Garcia, you sign a payment processor contract with yet another Ponzi scheme.

NextGen began as BizzTrek, a pyramid scheme launched in late 2018.

BizzTrek collapsed around mid 2019. This prompted the launch of BizzTrade, a forex themed Ponzi scheme.

BizzTrade collapsed in mid 2020, prompting a reboot with “BizzCoin” and crypto trading.

BizzCoin’s crypto Ponzi collapsed towards the end of 2020. 2021 was spent coming up with excuses.

In December 2021 BizzTrade Pro launched. BizzCoin was swapped out for BizzCoin Pro, and the Ponzi scamming continued.

By March 2022 BizzTrade Pro had collapsed, which brings us to NextGen’s launch in May 2022.

NextGen sees affiliates invest in AMGEN (another created shitcoin), on the promise of a passive 400%. Crypto trading is out, with the Gohar brothers resurrecting their forex ruse.

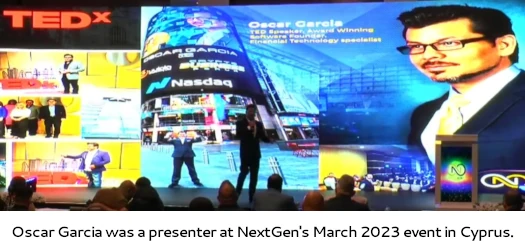

Between March 10th and 12th, NextGen held a marketing event in Cyprus.

Introduced on stage at the event was none other than Oscar Garcia.

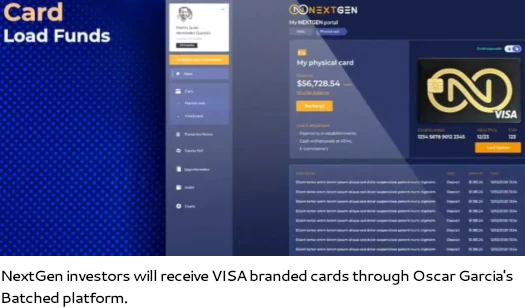

After doing a song and dance about “banking the unbanked”, Garcia introduces what appears to be white labelling of his Batched platform for NextGen.

We built something that your founders said, “do it because we will run with it”.

And they understood this. We didn’t just build a payment system, we built so much more. And that’s what we’re here to see.

Welcome to your own neobank in Nextgen. This system does exactly what the Visa Network does.

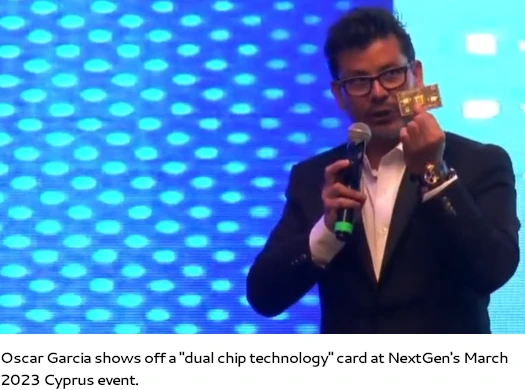

Garcia goes on to reveal a “dual chip technology” card.

Stage two is dual chip technology. Stage two is what if you can liquidate crypto right into one of the chips, and the other chip is just fiat.

We’re working with banks around the world to make this program work.

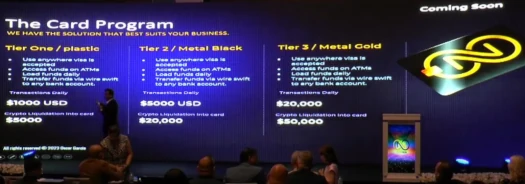

Garcia’s cards will be given to NextGen affiliates in three tiers:

- Tier 1 (plastic card) – $1000 daily transaction limit and $5000 crypto liquidation limit

- Tier 2 (black metal card) – $5000 daily transaction limit and $20,000 crypto liquidation limit

- Tier 3 (gold metal card) – $20,000 daily transaction limit and $50,000 crypto liquidation limit

NextGen’s AMGEN Ponzi token has been integrated into Garcia’s offering.

You can use your coin to initiate the transaction to secure it and move it, and now you’ve got liquidity.

Garcia doesn’t mention the “node validation” Ponzi component of Batched. Whether that’s being offered to NextGen investors or not is unclear.

Interestingly enough, Garcia claims he was going to launch this system “months ago”. He states he was using the same bank as FTX, and after FTX collapsed the bank demanded a review.

We were launching this thing months ago, but then that (FTX collapsing) happened (and) they (the bank) said no we gotta review everything.

VISA had already qualified the plastic card design and we were moving forward. So it created a roadblock.

FTX collapsed in early November 2022. A few months earlier Garcia learned of an SEC investigation into Batched.

That investigation began in September 2022 and, at time of publication, remains ongoing.

Whether Garcia’s dealing with NextGen fall within the scope of the SEC’s investigation remains to be seen.