In an “urgent request” sent out to NovaTech FX investors over the past 24 hours, the Ponzi scheme is demanding they

go through your posts on Social media (Facebook, Instagram, Twitter, YouTube, etc) and ensure that any/all posts with an ROI or ANY advertisement, solicitations that have NOVATECH’s name or logo on it… gets DELETED IMMEDIATELY & without hesitation!

If you see anyone doing so, please kindly communicate/inform them accordingly. Not deleting/ removing such posts may lead to having their NOVATECH account closed.

The problem of course is that, regardless of what you call your fraudulent investment scheme, it’s still a fraudulent investment scheme. Hence the term “pseudo-compliance”.

MLM related securities fraud in the US starts with the identification of an investment contract. This is done via the Howey Test.

Under the Howey Test, an investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

With respect to NovaTech FX, it itself is the “common enterprise”. Affiliates invest on the promise of a weekly ROI, which satisfies “a reasonable expectation of profits”.

NovaTech FX represents passive returns are funded via trading, satisfying “profits to be derived via the efforts of others”.

And so having satisfied all prongs of the Howey Test, NovaTech FX’s MLM opportunity constitutes a securities offering under US law.

This shouldn’t come as a surprise. BehindMLM identified NovaTech FX as an unregistered securities offering in 2019.

We maintain that any MLM company committing securities fraud does so because it’s a Ponzi scheme.

Getting back to regulation, the existence of an investment contract means NovaTech FX has to register with the SEC and be filing periodic audited financial reports.

They aren’t – and this is likely what will prompt an SEC lawsuit at some point.

Historically when states start issuing securities fraud cease and desists the SEC isn’t far behind. When the federal regulator pulls the trigger however can’t be predicted with accuracy. Ditto whether the DOJ will combo criminal charges.

Certainly there has been a recent trend of US authorities going not only after company owners, but also top promoters of MLM Ponzi schemes.

While investors will scramble to meet NovaTech FX’s “delete the evidence” directive, it won’t have any effect on pending regulatory proceedings.

The SEC and DOJ have never lost a securities fraud related case because evidence was deleted and “this is not financial advice”.

What will prompt investors to comply with NovaTech FX’s demands is the threat of losing their investment account(s). The irony being that it’s of course already too late to withdraw.

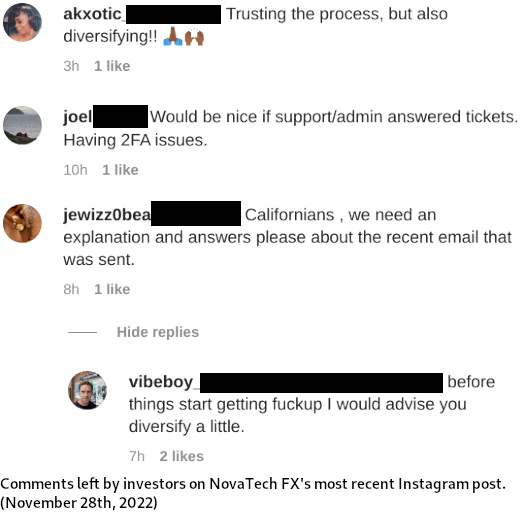

NovaTech FX investors familiar with Ponzi scheme end-games are already advising others to “diversify”

“Diversify” is scam-speak for “withdraw everything”.

At time of publication NovaTech FX has not publicly addressed California’s securities fraud cease and desist. Pending any additional updates, we’ll keep you posted.