made it clear from the outset that we were in no position to provide potential clients with financial advice as to whether they should invest with MTI, as we are not financial advisors, nor are we specialists in Bitcoin or any other form of cryptocurrency trading.

URA is in no way affiliated to MTI and can accordingly not be held responsible or liable for any profit or loss arising from any investment made, using the MTI platform.

If that sounds like a law firm desperately trying to cover its ass, you’re not wrong.

Here’s why.

The following are excerpts from just one Mirror Trading International webinar, on which Ulrich Roux, owner of Ulrich Roux and Associates, made an appearance.

The webinar in question took place on November 27th, shortly after the FSCA conducted its raids.

Cheri Marks, suspected owner of MTI, hosts the call.

She opens by describing Ulrich Roux and Associates as being in Mirror Trading International’s corner.

We are very fortunate in Mirror Trading International to have excellent contractors in our space and in our corner, that understand our structure.

That understand our directors, that understand our shareholders, and also understands the dynamic of how Mirror Trading International functions.

That would of course mean Ulrich Roux and Associates are in on MTI being a Ponzi scheme.

Marks claims that Roux is on the webinar to

tell you a little bit about what his view is on where MTI is at legally. What the situation is with the FSCA and really to give you an idea of where our minds are at … and what we foresee happening going on forward.

The first thing Ulrich Roux clarifies is that his firm’s relationship with MTI “goes back quite some time”. Mirror Trading International launched around mid 2019.

We’ve always believed in the MTI strategy and in the way you do business.

Ignoring securities fraud altogether, Roux goes onto state why he thinks the FSCA began investigating MTI.

We want to see, not only the business, but especially all the members and leaders that are on this call do well.

And I think that is the basis of all the negative attention that MTI is actually getting from the FSCA… is that they simply cannot fathom how a business can get such good returns for their members, and uh, yes.

We pointed that out to them (and) that is why they are attempting to muzzle you.

How simplistic. South Africa’s top financial regulator just doesn’t want to see Ponzi scammers do well.

Good grief.

Roux goes on to answer some questions posed by Marks. The first question pertains to MTI’s legal status in South Africa.

Whether intentionally or out of ignorance, Roux ignores securities fraud and instead presents the “bitcoin isn’t regulated” argument.

The current regulatory position of cryptocurrency still remains questionable.

For those following at home, the regulatory issue with MTI has and always has been the offering of securities. Whether MTI commits securities fraud with fiat or cryptocurrency is neither here nor there.

Yet on the public record, this is what Ulrich Roux had to say;

Cheri: So if I understand you correctly, where we stand right now is that there are no clear regulations for companies that function like MTI does?

Ulrich: None whatsoever.

This is a flat-out falsehood.

So the regulatory body in South Africa which regulates financial institutions, and institutions who invest funds mainly on behalf of clients, is the FSCA.

And the FSCA is a very conservative and strict regulatory body. They insist on being informed at all time about all of the personal information of people who invest with companies.

As well as having inside knowledge of all investments and all returns.

I believe what Roux is referring to here are periodically filed audited financial reports, which are used to verify investment companies like MTI are actually doing what they claim to be.

And obviously we are saying that is something that in the cryptocurrency world is not possible.

Roux doesn’t elaborate on why the use of cryptocurrency means MTI can’t provide audited financial reports showing the source of withdrawal funds.

As we state with any MLM company committing securities fraud, BehindMLM’s position on this is they don’t because MTI is a Ponzi scheme.

Rather than acknowledge his own ignorance of securities law, Roux puts forth it is the FSCA that has “no clue”.

As of today and this point in time, it seems as if they (the FSCA) have no clue, to be honest.

So um it is still very much in development and we’ll have to wait and see if they do come up with proper regulations in order to regulate the industry.

When asked what the driving force behind the FSCA’s investigation into MTI is, Roux responded;

To sum it up I think that the reason for these actions is simply that they cannot fathom how people can give such a good return on their investments.

I have to point out here that the FSCA’s job isn’t to “work out” anything. The onus is on MTI to register with the FSCA and provide them with audited financial reports.

For them it’s unfortunately a question of if it seems to good to be true than it is to good to be true.

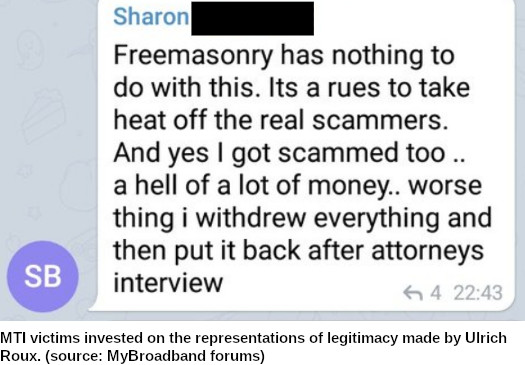

As many MTI promoters are now coming to grips with, many of whom might have relied on Roux’s representations of MTI’s legitimacy and acted on his financial advice, this is perhaps the one truth Roux puts forth.

Unfortunately after that one moment of truth, Rouxquickly retreats back to pushing false narratives.

Because of their lack of knowledge of cryptocurrency and their simple disbelief of the good returns that MTI is getting for their members, they have taken these steps, believing that there’s going to be some pot of gold at the end of the rainbow they’re going to get their hands on.

I think that is the main driving force behind their actions.

Indeed one of the tasks financial regulators engage in is asset recovery. This is so there’s something to distribute to victims when all is said and done.

As a primary benefactor of stolen investor funds, you can see why Cheri Marks is against this. MTI affiliates have claimed Roux has a position or positions within MTI.

He himself has not clarified this claim.

Question after question, Roux feeds Mirror Trading International affiliates, in his professional capacity as a lawyer, with false information.

Cheri: Legally what can the FSCA do to shut down MTI’s operations?

Ulrich: Yeah so, at this point in time it is impossible for the FSCA to summarily close MTI.

Roux does lay out a legal pathway towards the FSCA shutting MTI down, but states it “would be very difficult for them to do that”.

In reality if the South African police investigating MTI arrested Cheri Marks and the other ringleaders, MTI would be shut down overnight.

Those investigations however remain ongoing, with no further action taken at the time of publication.

I think one of the main driving forces as well behind the FSCA’s actions is they are definitely trying to destabilize the cryptocurrency market.

And the way that you do that is to create doubt in the market and to sow y’know, you’ve never seen a regulatory body see so many press-releases as the FSCA does.

And it is purely to try and cause confusion and destabilize members who are getting great returns and for them to start (???) those returns.

So that is also the reason behind the actions.

But just to put everyone’s fears to bed, they cannot simply just bring an application to close MTI down. It is impossible in terms of our law to do so.

Roux’s statement draws a sigh of relief from Marks. To which Roux responds with laughter.

In response to why MTI won’t pursue turning over the granted search warrants to the FSCA, Roux states “the horse has already bolted”.

To try and set the warrants aside now is unfortunately is not going to benefit MTI whatsoever.

But I do guarantee you, I do guarantee everyone else on the call that if it comes out that there was nothing untoward found, which we believe is going to be the case, then we will definitely be getting a public retraction and apology from the FSCA for these actions.

Cheri thanks Ulrich and emphasizes the “value of having Ulrich Roux and Associates back MTI”.

Three weeks later on December 18th, the FSCA released a press-release declaring Mirror Trading International was an “illegal operation”.

On December 22nd Ulrich Roux and Associates announced the firm was withdrawing as MTI’s attorneys.

Whether South African authorities pursue Roux for rubber-stamping the fraudulent Ponzi scheme remains to be seen.