Uncovering GSPartners’ secret stock investment scheme begins with a recent GSPartners webinar.

On the webinar GSPartners owner Josip Heit explained;

In your MetaBroker portfolio, you will have stocks as well. You will have stocks as well, yes?

And I am pretty sure this portfolio will be also some stocks, very similar to our company, linked to us.

But this we will let to the members of the board of that company to announce. It’s a regulated environment. It’s a regulated business.

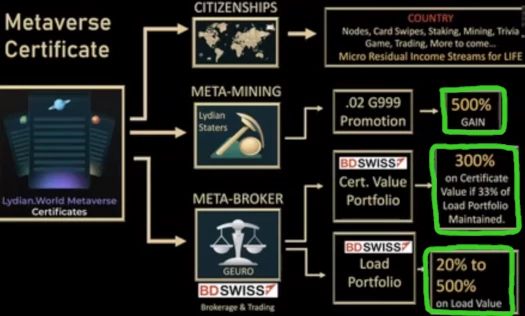

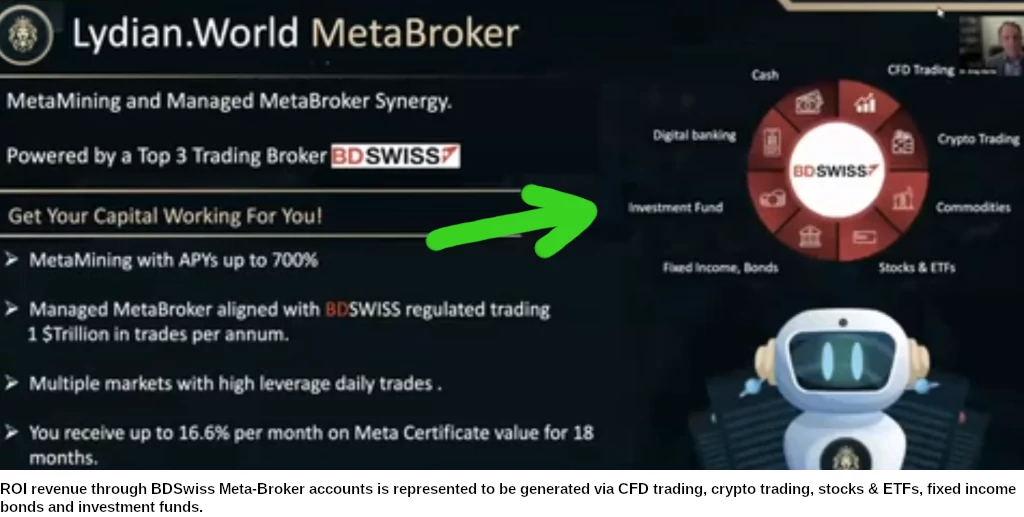

GSPartners’ Meta-Broker portfolios are offered through BDSwiss.

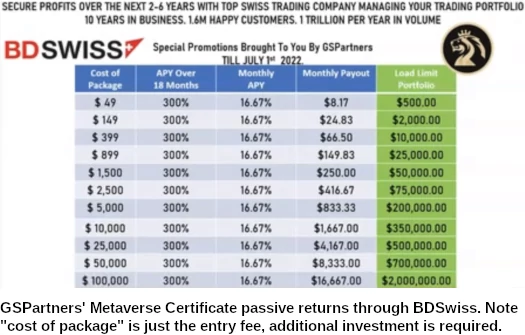

Through Meta-Broker portfolios, GSPartners affiliates are promised a 300% ROI on fees paid, as well as up to 700% annually on funds invested.

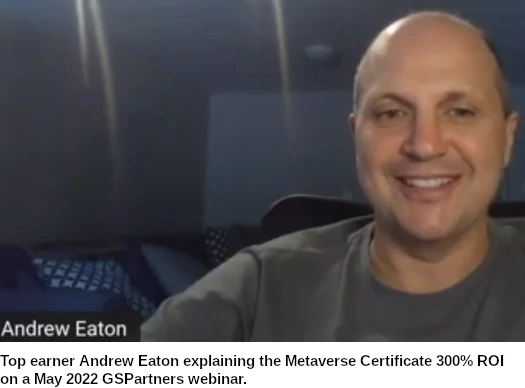

On another recent GSPartners’ webinar, top South African earner Andrew Eaton represented the advertised 300% ROI was “guaranteed”.

It’s a $10,000 certificate. As long as the minimum requirement to keep the trading account is there … I believe it’s going to be about 33% … as long as you keep that active, that $10,000 they paid for their certificate goes into a … solution that BDSwiss have come up with with Josip.

And as long as they keep their minimum trading activity active, that $10,000, as an example they spent on a certificate, they will be guaranteed 300% returns on that over 18 months.

To fund Meta-Broker portfolios, GSPartners are letting affiliates dump worthless G999 tokens from previous failed GSPartners’ Ponzi ventures.

The exchange rate for G999 is 2 cents per coin. G999 is currently publicly trading at $0.004. This value is subject to ongoing manipulation by GSPartners.

Till June 30th, GSPartners is also offering to double any investments made into partnered BDSwiss Meta-Broker portfolio accounts.

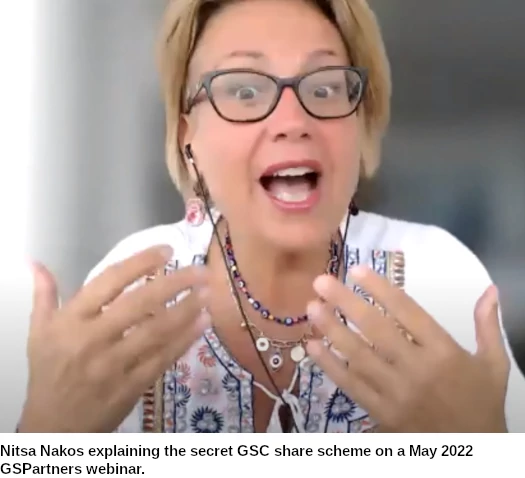

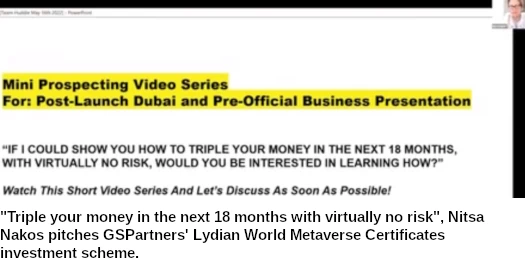

Speaking on the partnership between BDSwiss and Lydian World, Canadian GSPartners affiliate Nitsa Nakos stated on yet another recent webinar;

This company, BDSwiss, is now partnered with Lydian World. They are now our official trading house, trading brokers.

They are creating for us unique products. Products that they do not offer on their website. These are high-leverage trading products, provided in the metaverse.

Nakos is referring to GSPartners’ new Lydian World investment plans. She’s also referring to GSPartners’ secret share scheme. This ties into the “stocks” we quoted Josip Heit on earlier.

Nakos refers to the GSPartners’ share scheme as “big news we do not openly promote”.

It is big news but it is not big news that we openly promote.

In small settings, in one on one conversations, when we know who we’re speaking to, when we know their intention, when we know their interest, y’know, we can bring up the conversation around our sister company, GS Chain.

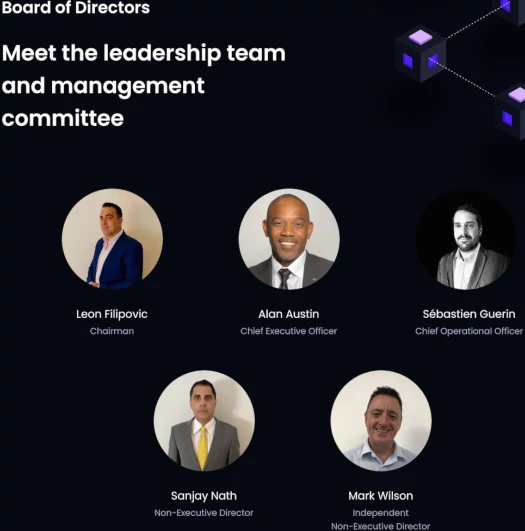

GS Chain is a UK shell company set up and owned by Josip Heit.

Rather than just be honest about that though, GS Chain is fronted by these fall guys:

GS Chain was incorporated in the UK in April 2021 as GS Chain PLC. The provided GS Chain PLC corporate address is a London virtual office.

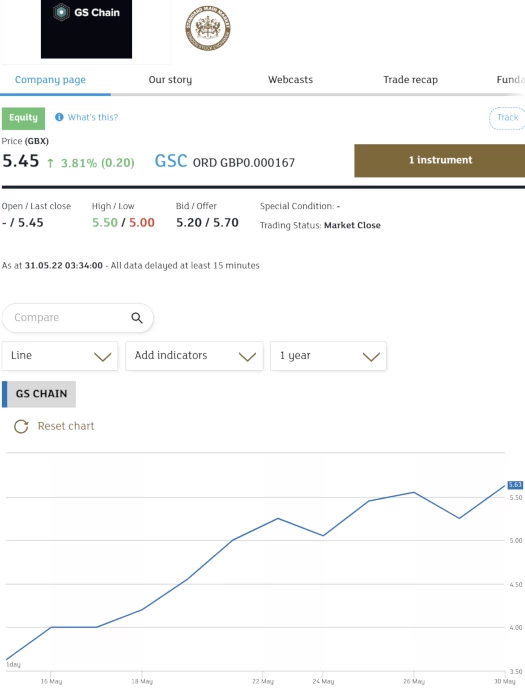

Through GS Chain and its GSC shares, Heit and GSPartners have gained access to the London Stock Exchange:

GSC affiliates were initially secretly allocated GSC shares when they invested in GSPartners’ various schemes.

Since the introduction of the Lydian World’s Metaverse Certificates Ponzi, GSC shares will now be part of commissions and bonuses awarded on recruitment of new GSPartners affiliate investors.

Neither GSPartners, GS Chain PLC or Josip Heit are registered with the UK’s Financial Financial Conduct Authority. Meaning GSPartners’ secret GLC share scheme, offered in conjunction with BDSwiss, violates UK financial regulations.

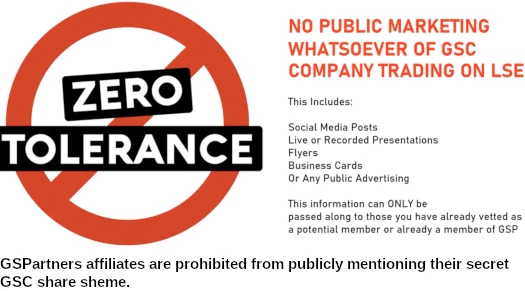

As a result, this is how GSPartners have to market their secret GLC share investment scheme:

Nitsa Nakos continues;

I ask all of you, I need all of you to endorse this and to really follow this protocol. There is zero-tolerance whatsoever of advertising about our listing. There’s no need to.

It includes no social media posts. No live or recorded presentations that mention [sic]. No flyers, no business cards or any public advertising whatsoever.

Let’s just put it this way; The only time that we should even mention anything, is if we are 100% sure the person that we are speaking to is who they are.

And y’know, not from a regulatory or law enforcement agency.

Can’t have them finding about our little secret share scheme now, can we.

That they have a sincere interest. That they’re saying, “I want to come in and I do want to invest my money. I am serious. Tell me what you can tell me about this stock listing.”

Again everyone, everyone here I think we have an understanding, maybe some a little deeper because of your backgrounds (Ozedit: in case it wasn’t clear, Nakos is referring to financial fraud), that do deal with the Securities and Exchange Commissions in these regulated, highly highly regulated markets, you have to be squeaky clean.

You can’t have one thing on you. Because if anyone is going to do the due-diligence, it’s them.

Putting aside registering a shell company in the UK and getting a LSE listing doesn’t itself involve any regulator due-diligence (regulation is reactionary to fraud and dysfunctional in the UK at best), let’s examine the regulatory side of GSPartners’ Lydian World Ponzi, BDSwiss and the GLC share investment scheme.

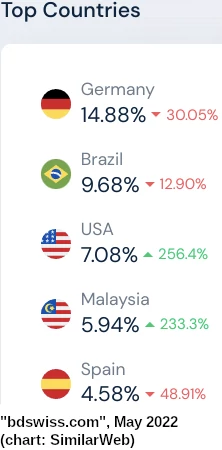

Courtesy of SimilarWeb, we can see the majority of visits to GSPartners’ and Lydian World’s websites are from the US:

This isn’t a new development, it’s been this way for some time. It follows that the majority of GSPartners affiliate investors are thus also from the US.

The offer of “managed trading” passive returns on USDT investment, including a 300% passive return on fees paid, constitutes a securities offering.

This requires registration with the SEC, as per the Securities and Exchange Act.

Neither GSPartners, Lydian World, Josip Heit or BDSwiss are registered with the SEC.

The offer of PLC shares to GSPartners as an investment opportunity requires registration with the the CFTC, as per the Commodity Exchange Act.

Neither GSPartners, Lydian World, GS Chain or Josip Heit are registered with the CFTC.

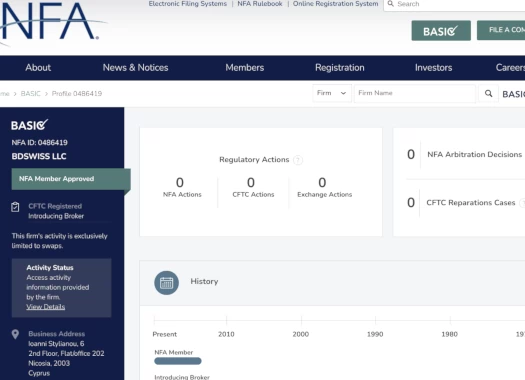

BDSwiss is registered via the NFA through BDSwiss LLC, a Cyprus shell company.

Curiously, BDSwiss also has a US LLC shell company. For whatever reason (I can’t imagine why), BDSwiss hasn’t linked its US shell corporation to its NFA membership.

BDSwiss’ NFA registration lists Jan Eric Malkus as owner of its BDSwiss LLC Cyprus shell company.

Malkus is a German national, which fits with Josip Heit’s ties to Germany.

Malkus also has a history of offshore shell company shenanigans. More relevant to our research is Malkus being the co-founder, Director and Chairman of BDSwiss.

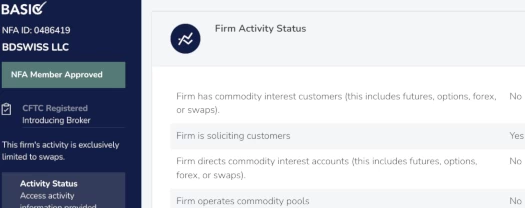

Putting aside BDSwiss’ NFA registration doesn’t cover services provided by GSPartners and Lydian World, if we look at the specifics of its membership…

…we learn it was granted on the basis BDSwiss

- does not have commodity interest customers (this includes futures, options, forex, or swaps);

- does not direct commodity interest accounts (this includes futures, options, forex, or swaps); and

- does not operate commodity pools.

Here’s how BDSwiss purportedly generates advertised returns of GSPartners’ and its own clients (click to enlarge):

When we square BDSwiss’ NFA membership against GSPartners’ Lydian World Metaverse Certificate investment, in which ROI revenue is represented to be generated via trading, and the GSC share investment scheme, we surmise that BDSwiss’ NFA membership was obtained, or at the very least following partnership with GSPartners is now retained, on false premises.

To conclude; neither GSPartners, Lydian World or BDSwiss (with respect to GSPartners), have met any regulatory requirements for their passive investment scheme or share investment scheme in the US – whilst maintaining and continuing to solicit a primarily US-based investor base.

According to Nakos, BDSwiss is going to start pushing GSPartners’ Ponzi scheme onto their own “1.6 million” clients.

These 1.6 million clients, that are already with BDSwiss, many of them, in their dashboard, they will see “metaverse, metaverse, high leveraged trading, high leveraged trading”.

They’re going to want to come and, with a click of a button, they’re going to be in our metaverse utilizing these high leverage trading products.

So what does that mean to us?

It means everything to us.

Anytime we see this community (GSPartners) grows … it’s good for everybody.

People who come and invest in the metaverse, that invest in this project, what are they investing in?

They’re investing in the coins, G999. They’re investing in the Lydian World, the Lydian Stater Coin, and then they’re investing in the metaverse.

The different products they can take over there, to make even more more money. More passive income.

Nakos hopes the injection of funds from BDSwiss account holders will push GSPartners to one billion in invested funds.

In addition to heavily leaning on BDSwiss’ feigned legitimacy, Nakos also makes full use of “MetaStars” endorsements Josip Heit is cultivating.

Now we have a credible name. Now we have all the licenses. Now we can bring our people and we can be safe, and we can be secure, and our name is credible.

This is why celebrities are now coming on board.

Like olympic gold medal winner, boxing champion of the world, and very, very savvy crypto investor, Floyd Mayweather.

Floyd Mayweather, well his lawyers, have looked through our company for many, many weeks. Many, many weeks. They have taken a deep-dive.

And he is a sports celebrity. Of course he is, y’know, used to sponsorships … but these sports celebrities would not just attach their name to something that is not credible. To something that does not have long-term sustainability.

So now that they have seen that this company (GSPartners), number one has vision, number two has the resources to continue to develop and to innovate, and number three, has the credibility and the backing of such companies like BDSwiss, now are going to start to come the celebrities.

The first one is already there, announcing his endorsement if you will. Call him an ambassador, and there’s more. And there will be more.

We do expect, in the next twelve to eighteen months, that we will have many, many celebrity endorsements for Lydian World.

Nakos goes on to suggest Mayweather has actually invested into GSPartners’ Lydian World Ponzi scheme.

These celebrities, they don’t just earn sponsorships, these celebrities have positions in the metaverse.

These celebrities promote the metaverse to their followings, to their fans.

So again, this helps us on our road to one million users and one billion dollars in revenue.

In November 2018 the SEC charged Floyd Mayweather for

failing to disclose payments they received for promoting investments in Initial Coin Offerings (ICOs).

The SEC’s orders found that Mayweather failed to disclose promotional payments from three ICO issuers, including $100,000 from Centra Tech Inc.

The SEC order found that Mayweather failed to disclose that he was paid $200,000 to promote the other two ICOs.

I haven’t seen how much Mayweather was paid to promote GSPartners and Lydian World as a “Brand Ambassador”, including how much he invested and/or was gifted in Metaverse Certificate investment positions, disclosed anywhere.

The SEC went on to file civil charges against Centra Tech’s owners for offering and selling “unregistered investments through a “CTR Token.””

Paralell criminal charges were also filed against Centra Tech’s co-founders.

One was sentenced to one year in prison in December 2020. Centra Tech’s other co-founder copped an eight year prison sentence in March 2021.

“These cases highlight the importance of full disclosure to investors,” said Enforcement Division Co-Director Stephanie Avakian.

“Investors should be skeptical of investment advice posted to social media platforms, and should not make decisions based on celebrity endorsements,” said Enforcement Division Co-Director Steven Peikin.

“Social media influencers are often paid promoters, not investment professionals, and the securities they’re touting, regardless of whether they are issued using traditional certificates or on the blockchain, could be frauds.”

Given the multiple GSPartners and BDSwiss regulatory violations in play, in addition to Mayweather’s disclosure failures, “could be frauds” seems redundant.

Update 31st May 2022 – I’ve published a followup on how Josip Heit was able to get GS Chain listed on the London Stock Exchange.