The arrests preceded a securities fraud warning issued against the Ponzi scheme on June 13th.

When the Philippine SEC began investigating Decentra is unclear.

As per a June 15th press-release issued by the Philippine government though, we learn the Decentra arrests happened on June 10th.

The SEC, through a mission order dated June 10, authorized and deputized a team of the PNP-ACG personnel, together with the EIPD, to conduct the joint entrapment operation, after receiving an email tip on Decentra’s unauthorized investment solicitation activities.

The bust took place during a local organized Decentra promotional event.

In a joint operation on June 11, the combined forces of the SEC Enforcement and Investor Protection Department (EIPD) and Philippine National Police Anti-Cybercrime Group (PNP-ACG) arrested the officers of Decentra while in the act of soliciting investments from the public without the requisite license during a seminar or business presentation in a hotel in Quezon City.

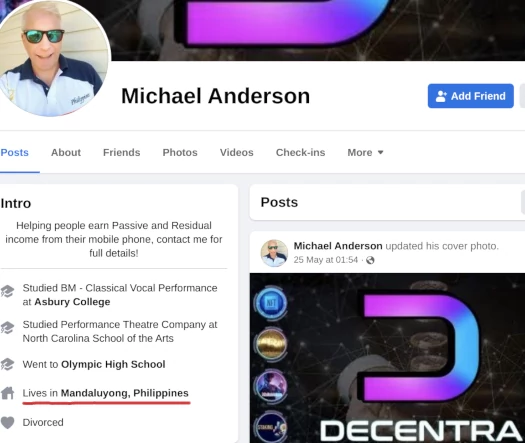

The Decentra officers –identified as Arnel Laxa, Michael Anderson, Arnold Black, Rodolfo A. Asadan, Roberto A Betinol, Fritzie Abalde, Nely Carvajal, Wyndell Español, Jenny A Tampulan, Alice Fabroa, Lawrence Ruiz, Kieth Reñola, Mary Joy Mendoza, Joy Esclamado, Rose Marie Razon, Analiza Narvaez, Warpath Chu, Teodorick Acuña, and Fe Paglingayen– were arrested for violation of Sections 8.1, 26.3, and 28 of Republic Act No. 8799, or the Securities Regulation Code (SRC), for publicly offering securities without a license from the SEC.

BehindMLM flagged Michael Anderson as a central promoter of Decentra in the Philippines yesterday.

According to the press-release, two of the arrested Decentra promoters are foreign nationals.

Decentra was found to be offering several investment packages online, with an initial membership fee of 99.95 Tether (USDT).

Members are promised returns of up to 120 percent of their initial investment depending on the package they avail and the number of recruits they invite into the system.

In an advisory dated June 13, the EIPD said Decentra was not registered with the commission as a corporation, partnership, or one person corporation.

Accordingly, it did not have the secondary license for the solicitation of investments, as required under the SRC.

One particularly interesting aspect of the Philippine Decentra investigation was uncovering local scammers were former Crowd1 Ponzi promoters.

The EIPD also found that Decentra was headed by former members of Crowd1 Asia Pacific, Inc.

Like Decentra, Crowd1 is based out of Dubai. Philippine authorities identified Crowd1 as a scam and banned it in June 2020. The regulatory ban was reaffirmed last month.

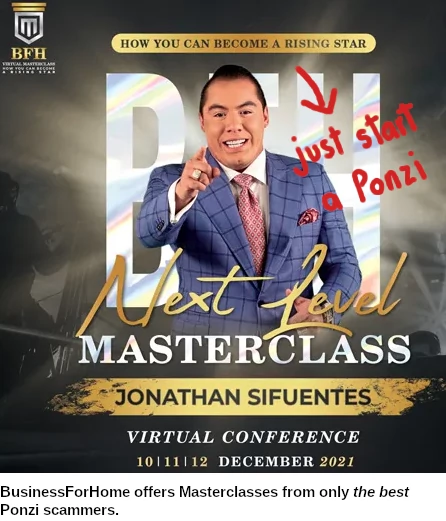

Decentra founder Jonathan Sifuentes fled to Dubai shortly after his January 2022 arrest in Mexico.

Once safe in the MLM crime capital of the world, Sifuentes rebooted Xifra Lifestyle as Decentra.

It is my understanding that since fleeing to Dubai, Sifuentes has not attended any Decentra promotional events.

Two have been held thus far; a launch event in Dubai last month and a follow up in Mexico, where a large percentage of Xifra Lifestyle investors were recruited.

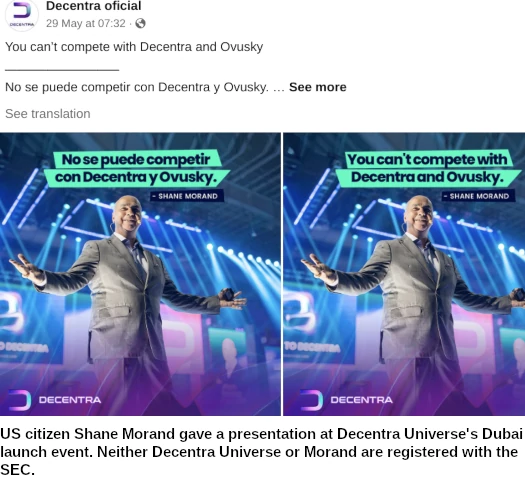

Instead of headlining the events himself, Sifuentes sent out Shane Morand to run them.

Morand, a US citizen and former Organo Gold executive, relocated to Dubai earlier this year to be part of Decentra’s executive team.

Jonathan Sifuentes is also facing regulatory action in the US. Whether US authorities are investigating Xifra Lifestyle and the Decentra reboot is unclear.

SimilarWeb pegs top sources of traffic to Decentra’s website as Martinique (55%), Colombia (24%), Ecuador (9.5%), Spain (6%) and Latvia (5%).

Martinique is a small island in the Caribbean. With a total population of just 376,480, Decentra scammers targeting the island is particularly concerning.

Back in the Philippines, the SEC warns it will continue

to combat the spread of investment scams in the country by actively going after perpetrators of unauthorized investment schemes and implementing investor education programs to improve financial literacy.

Promoters of MLM companies committing securities fraud risk a PHP 5 million fine (~$93,733), or up to twenty-one years in prison.