The DDK web site identifies husband and spouse, Datuk Azrainuddin Zainal (aka Arai Ezzra) and Datin Nur Ezdiani Baharoddin as co-founders of the corporate. Nurshuhada Zainal holds the place of DDK’s CEO.

That is additionally presumably the place DDK is being operated from.

Alexa at present cite Malaysia, Indonesia and Brunei as offering 83% of visitors to the DDK web site.

Regardless of being very clearly operated from Malaysia, DDK claims it’s “certain to Singapore guidelines and regulation”.

Though not explicitly clarified on the DDK web site, presumably the corporate has established a number of shell firms in Singapore.

So far as I can inform, DDK has no precise bodily operations in Singapore.

Advertising and marketing materials on the DDK web site reveals DDK beforehand launched a DinarCoin (DNC) in late 2015.

DNC seems to be your typical MLM pump and dump shitcoin. It was solely tradeable internally and collapsed as soon as new traders stopped investing.

In late 2017 DDK dropped DNC in favor of a brand new altcoin, DDKoin.

Learn on for a full assessment of the DDK MLM alternative.

DDK Merchandise

DDK has no retailable services or products, with associates solely capable of market DDK affiliate membership itself.

The DDK Compensation Plan

DDK associates spend money on DDKoin on the expectation of a ROI.

DDKoin serves no objective exterior of DDK, whereby it’s only used to measure how a lot an affiliate has invested.

DDKoin isn’t publicly tradeable, that means DDK can set it’s worth at no matter they need by means of their Common Blockchain Pockets inside alternate.

The present inside worth of DDKoin isn’t disclosed on the DDK web site.

As soon as invested in, DDK associates are capable of park their DDKoin with the corporate.

This pays out a ROI on the parked DDKoin, at a price of

- 10% over the primary 12 months

- 8% over the following 6 months

- 6% over the following 6 months

- 4% over the following 6 months

- 2% each 12 months thereafter

This can proceed for so long as DDK has any of the 41 million pre-generated DDKoins it has to dump onto associates left.

DDK additionally provides associates who’ve invested in over 10 DDKoin the possibility to be “delegates”.

Delegates are charged 10 DDKoin. This price qualifies them to earn a proportion of transaction charges collected from DDK associates (paid in DDKoin).

Referral Commissions

DDK pays a ten% referral fee on DDKoin parked with the corporate by personally recruited associates.

Residual Commissions

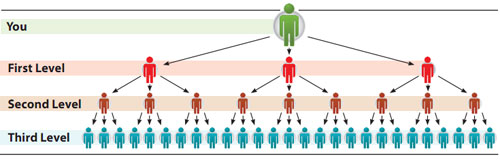

DDK pays residual commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel crew, with each personally recruited affiliate positioned straight beneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel crew.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

DDK caps payable unilevel crew ranges at fifteen.

Residual commissions are paid as a proportion of DDKoin acquired by unilevel crew associates who’ve parked their DDKoin with the corporate.

How a lot of a proportion is paid out is set by which stage of the unilevel crew a downline affiliate receives their parked DDKoin ROI on:

- stage 1 (personally recruited associates) – 5%

- stage 2 – 3%

- ranges 3 and 4 – 2%

- ranges 5 to 7 – 1%

- stage 8 – 0.9%

- stage 9 – 0.8%

- stage 10 – 0.7%

- stage 11 – 0.6%

- ranges 12 to fifteen – 0.5%

Becoming a member of DDK

DDK affiliate membership seems to be free.

Participation within the hooked up MLM alternative requires funding in DDKoin.

The DDK web site doesn’t specify a minimal funding quantity.

DDK associates who spend money on at the least 10 DDKoin are capable of buy “delegate” standing, which will increase their earnings potential.

Conclusion

DDK is your typical MLM Ponzi scheme.

DDKoin is a shitcoin that serves no objective exterior of DDK itself. Thus it’s also nugatory exterior of DDK.

The one cause a DDK affiliate would spend money on DDKoin is on the illustration its worth will enhance.

By offloading DDKoin onto new bagholders by means of DDK’s inside alternate, thus a ROI is achieved.

In an effort to string traders alongside for so long as attainable, DDK encourages associates to “stake” their DDKoin with the corporate.

This I’ve known as “parking” your DDKoins within the compensation plan evaluation of the assessment.

Basically you spend money on DDKoin, park your factors with the corporate they usually provide you with a ROI in your cash yearly, then each six months for a bit after which yearly once more.

This prices DDK nothing, as all they’re doing is dumping DDKoin onto associates that they’ve generated at little to no price.

Whereas all this nonsense is happening, Azrainuddin Zainal, Nur Ezdiani and Nurshuhada Zainal are gathering actual cash from DDK associates.

This cash is stashed away and by no means paid out once more.

The one exception to that is the small quantity initially used to pay returns, till there’s sufficient new gullible bagholders for preliminary traders to dump onto.

After that it’s all revenue for DDK and its administration.

Along with Ponzi fraud by means of their inside alternate, DDK can also be committing securities fraud.

DDK gives no proof of it having registered to supply securities in its three prime markets, Brunei, Indonesia and Malaysia.

The tip-game for MLM cryptocurrency Ponzi schemes like DDK is that inevitably new investor recruitment slows down.

This correlates with a scarcity of latest funding and exercise throughout the community, that means DDK administration and their delegates take a pay reduce.

Whereas preliminary traders steal most of what is available in from new traders, these satisfied to park their DDKoin with the corporate received’t notice there’s no person left to rip-off till it’s too late.

The 12 month lead time for the preliminary 10% parking ROI is loads of time for DDK to prepare dinner the books till associates truly try to money out.

When withdrawal requests languish or denied outright, the occasion is over and DDK collapses.

One last level I’d like to the touch on is Brunei showing to be the most important supply of latest DDK funding.

Brunei is a tiny nation of simply 428,000 individuals. Though the nation does have a securities regulator by way of the Capital Market Unit, there’s a great probability DDK can be their first main MLM cryptocurrency catastrophe.

My fear is that by the point DDK seems on the Capital Market Unit’s radar, the injury can have already been completed – each economically and socially.

What with Brunei having such a small inhabitants and the DDK web site at present the 271st most visited web site nationally, issues aren’t trying good.

Sadly for these in Brunei who’ve already invested (native ringleaders who’re doing the recruiting apart), your cash is already gone.

DDK can have laundered it by means of Singapore or no matter channels they’ve set as much as squirrel away invested funds.

Malaysia and Indonesia may be capable of take the hit when DDK inevitably collapses, however the penalties for Brunei could possibly be devastating.

Please take into account this earlier than roping your loved ones and buddies into DDK.

DDK’s idea may appear “new” and “contemporary” in a rustic not identified for cryptocurrency adoption. DDK nevertheless is actually no completely different to the remainder of the MLM crypto Ponzi schemes doing the rounds.

All of them collapse and the vast majority of traders in each considered one of them undergo actual losses.

Replace twenty sixth February 2019 – Following publication of this assessment, DDK has tried a rebuttal.

BehindMLM addressed DDK’s rebuttal in a separate article printed February twenty sixth.