Nominex operates within the cryptocurrency MLM area of interest.

Nominex’s web site area (“nominex.io”), was first registered in November 2017.

The personal registration, revealing solely Russia because the tackle of the proprietor, was final up to date on July 4th, 2021.

In an try to look official, Nominex gives a Seychelles incorporation certificates on its web site.

For the aim of due-diligence, fundamental incorporation in any jurisdiction is meaningless.

Emphasizing that is the company tackle in Seychelles that Nominex gives.

This tackle is utilized by a number of corporations, suggesting Nominex solely exists in Seychelles as a shell firm.

In accordance with his Fb profile, Shkitin relies out of Saratov, Russia.

Thus it’s confirmed Nominex is a Russian firm pretending to be primarily based out of Seychelles.

Previous to reinventing himself as a crypto bro and heading up Nominex, Shitikin had a programming and gross sales background.

On the time of publication Alexa ranks prime sources of site visitors to Nominex’s web site as Argentina (16%), Russia (15%) and Costa Rica (11%).

Learn on for a full evaluation of Nominex’s MLM alternative.

Nominex’s Merchandise

Nominex has no retailable services and products.

Nominex associates are solely in a position to market Nominex affiliate membership itself.

Outdoors of its MLM alternative, Nominex runs a cryptocurrency alternate.

Nominex’s Compensation Plan

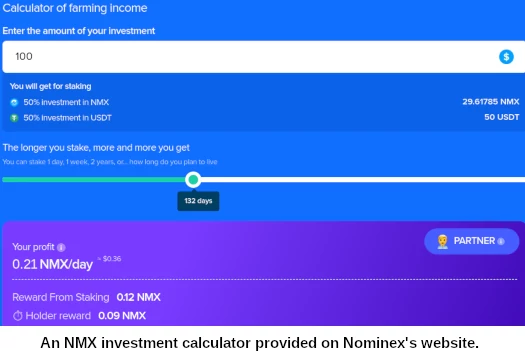

Nominex associates put money into NMX tokens on the promise of an annual return of “over 145%”.

Nominex associates may also make investments NMX and USDT, on the promise of a 500% ROI.

Nominex solicits funding in NMX tokens in varied tether packages (USDT):

- Starter – as much as 100 USDT

- Companion – 100 USDT

- Professional – 300 USDT

- VIP – 1000 USDT

- Elite – 5000 USDT

- Max – 10,000 USDT

The MLM aspect of Nominex pays commissions on recruitment of affiliate traders.

All commissions and bonuses are paid out in NMX tokens.

Referral Commissions

Nominex associates obtain a proportion of USDT invested by personally recruited associates.

Referral fee charges are decided by how a lot a Nominex affiliate has invested:

- Starter and Companion – 20% referral fee fee

- Professional – 25% referral fee fee

- VIP – 30% referral fee fee

- Elite – 35% referral fee fee

- Max – 40% referral fee fee

Referral commissions are additionally paid on NMX returns paid to personally recruited associates.

Once more ROI referral fee charges are decided by how a lot a Nominex affiliate themselves has invested:

- Starter – no ROI referral commissions

- Companion – 5% ROI referral fee fee

- Professional – 8% ROI referral fee fee

- VIP – 10% ROI referral fee fee

- Elite – 15% ROI referral fee fee

- Max – 20% ROI referral fee fee

Residual Commissions

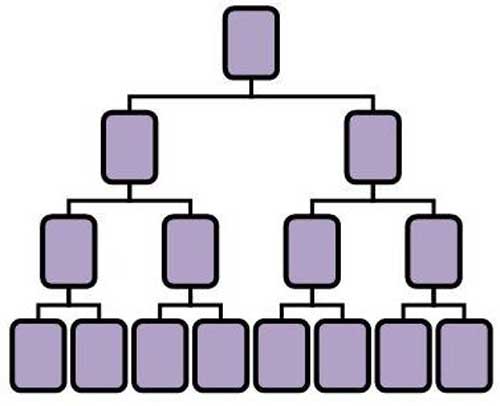

Nominex pays residual commissions by way of a binary compensation construction.

A binary compensation construction locations an affiliate on the prime of a binary group, break up into two sides (left and proper):

The primary stage of the binary group homes two positions. The second stage of the binary group is generated by splitting these first two positions into one other two positions every (4 positions).

Subsequent ranges of the binary group are generated as required, with every new stage housing twice as many positions because the earlier stage.

Positions within the binary group are stuffed by way of direct and oblique recruitment of associates. Observe there isn’t any restrict to how deep a binary group can develop.

Nominex pays residual commissions as a proportion of returns paid to their weaker binary group aspect. That’s the aspect that receives much less in each day returns.

Residual fee charges are decided by how a lot a Nominex affiliate has invested:

- Starter tier associates don’t obtain residual commissions

- Companion tier associates obtain a 5% residual fee fee

- Professional tier associates obtain an 8% residual fee fee

- VIP tier associates obtain a ten% residual fee fee

- Elite tier associates obtain a 15% residual fee fee

- Max tier associates obtain a 20% residual fee fee

Payment Commissions

Nominex associates earn a proportion of charges collected from their personally recruited associates.

Payment fee charges are usually not disclosed.

Becoming a member of Nominex

Nominex affiliate membership is free.

Full participation within the connected MLM alternative requires a minimal 100 USDT funding.

Nominex Conclusion

Nominex claims its administration group are

3 musketeers combating for you and for the Nice crypto Justice.

In actuality they’re simply operating one other MLM crypto Ponzi scheme – which in the end will primarily profit themselves.

Such that there’s any legitimacy to Nominex’s alternate, it’s undermined by their NMX token Ponzi scheme.

Nominex associates put money into NMX tokens, park them with the corporate on the promise of a passive return, and ultimately money out subsequently invested funds.

The extra an individual stakes NMX-LP, the extra NMX tokens from the pool he’ll obtain.

Fortunately Nominex haven’t bothered with the “staking isn’t investing” pseudo-compliance.

Tokens obtained for affiliate exercise are indistinguishable from tokens for staking: they’ll, for instance, be reinvested to staking.

NMX itself is a BEP-20 token. These take a couple of minutes to arrange at little to no value.

The MLM aspect of Nominex focuses on recruitment of latest affiliate traders. This provides a further pyramid layer to the scheme.

As of April 2021 or so NMX has been publicly tradeable.

Above you possibly can see a pump to $7.33, after which comes the inevitable shitcoin dump to $1.66 and falling.

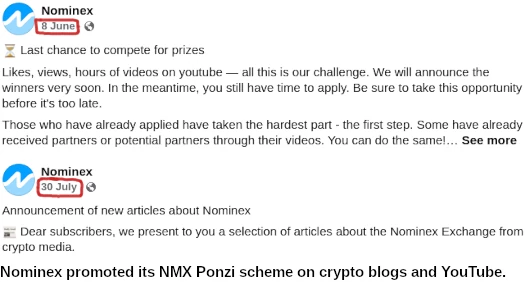

I used to be in a position to peg the June NMX run as much as aggressive social media advertising by Nominex, each on crypto web sites and YouTube.

In a weblog put up on its web site, Nominex revealed revealed they have been paying upwards of $10,000 for NMX token YouTube movies.

The issue is exterior of Nominex NMX is nugatory. Any worth by means of the alternate is dwarfed by the connected funding scheme.

Stated funding scheme, by advantage of it being a Ponzi scheme, will inevitably collapse.

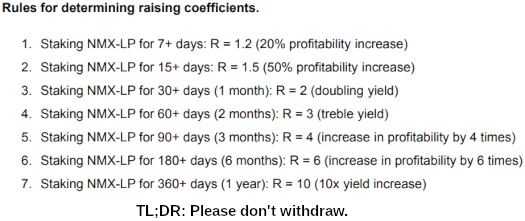

Nominex has carried out incentives to stop associates from cashing out…

To inspire an individual to not promote tokens, we have to present extra profitability.

Now we have already carried out the mechanics – the extra an individual stakes, the extra they earn NMX tokens.

…however these are stop-gap measures.

They will’t delay the inevitable withdrawals exceeding new funding situation.

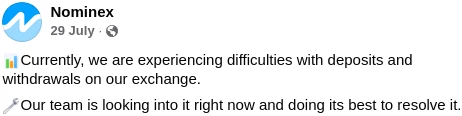

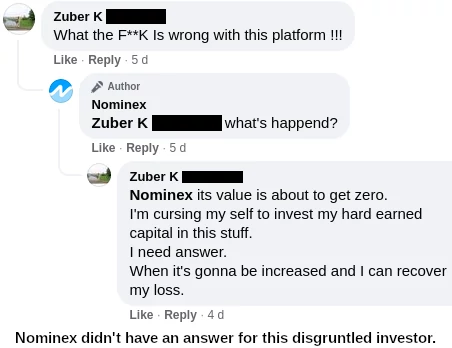

At any time when that occurs, be careful for one thing like this:

And/or Nominex will merely disappear. Be it disabled withdrawals or admins doing a runner, Nominex associates will likely be left bagholding nugatory NMX.

On the regulatory entrance, Nominex’s NMX token funding scheme constitutes a securities providing.

This requires Nominex to be registered with monetary regulators, which they aren’t (once more, shell incorporation in Seychelles is meaningless).

The Financial institution of Russia has taken a extra proactive position in figuring out and issuing securities fraud warnings of late.

Past that nevertheless Russian authorities have to this point did not comply with up with enforcement.

Within the meantime math is math and, regardless of whether or not Nominex collapses or authorities shut it down, nearly all of traders in Ponzi schemes all the time lose out.